Table of Content

(501 views)

Quick Summary

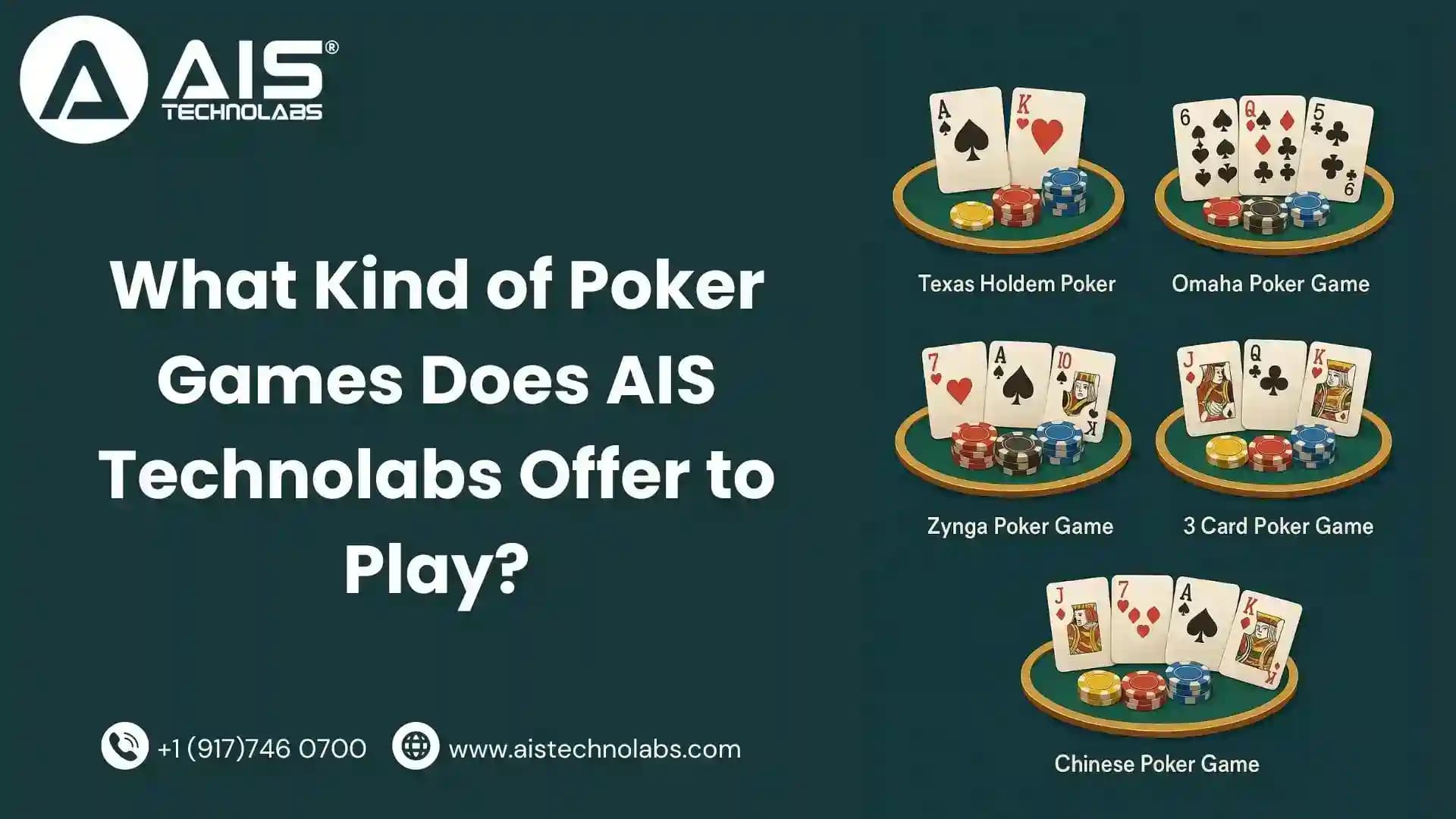

Are you looking for poker games to play? Welcome to AIS Technolabs, a leading poker development company offering a wide range of poker games for real money to help you grow your business. As an expert in poker game design, we specialize in creating secure and high-performance online poker software for businesses looking to cater to players globally. Whether you are a poker enthusiast or a business owner, we have the perfect poker game for you.

Poker games have transformed the gaming world, creating new opportunities for businesses and players alike. At AIS Technolabs, we offer a variety of exciting poker games that are accessible to anyone, anywhere, on both mobile and desktop. Whether you're a beginner or a seasoned player, our poker games are designed to be easy poker games to play at home or on the go. Let’s explore some of the best poker games that AIS Technolabs offers.

Texas Holdem Poker

Texas Holdem Poker is one of the most popular types of poker games worldwide. AIS Technolabs excels in Texas Holdem game development services, providing an immersive and secure online experience for players. This game comes in multiple formats such as no limit, limit, and pot-limit, with no-limit being the most popular.

In Texas Holdem, each player is dealt two hole cards, and they must use these cards combined with five community cards to create the best hand. The game follows a series of betting rounds, including pre-flop, flop, turn, and river. As a leader in poker software providers, AIS Technolabs ensures the game is optimized with high-quality visuals and secure gameplay.

Poker Overview: Whether you're new to poker or an experienced player, Texas Holdem offers a strategic challenge that makes it one of the best poker games to play online. It’s a game of skill, where understanding high hand holdem poker slot combinations and using tournament strategy software poker can give you the edge.

Omaha Poker Game

AIS Technolabs is a trusted Omaha poker game development company, known for delivering high-quality, cross-platform poker games for players worldwide. The Omaha poker game shares similarities with Texas Holdem, but it’s played with four hole cards instead of two. Players must select two cards from their hand to make the best five-card hand possible, using the five community cards.

Omaha is fast-paced and offers an exciting challenge. There are two popular versions of this game: Omaha High and Omaha 8-or-better. In Omaha 8-or-better, players aim for both a high hand and a low hand, with specific rules for qualifying the low hand. For those looking for the best poker game for real money, Omaha can be a great option.

As an Omaha poker game developers company, AIS Technolabs ensures the game is not only fun but also secure, making it one of the top choices for asian poker games and players across the world. Additionally, we offer comprehensive Omaha Poker Software Development services, ensuring that each game is optimized for both performance and security.

Zynga Poker Game

Zynga Poker is one of the largest and most recognized free-to-play poker games, and AIS Technolabs offers the best Zynga Poker card rules and software development services for this game. Players can enjoy fast-paced poker games with quick tournament sessions, lasting 5-8 minutes.

This game features the Spin and Win tournament, a fun and exciting mode where players spin a wheel to determine their rewards. Whether you're playing with real money poker or just for fun, Zynga Poker offers an excellent experience. Additionally, rules of Zynga Poker are easy to follow, making it one of the best easy poker games to play at home.

AIS Technolabs ensures Zynga Poker card rules are followed while adding advanced features like artificial intelligence and enhanced security solutions to make the game even more enjoyable for players.

3 Card Poker Game

AIS Technolabs also offers an exciting and easy-to-learn game: 3 Card Poker. This is a simple heads-up poker game where players compete against the dealer. The game involves an ante wager, and the goal is to have a better hand than the dealer. It’s a fun and fast-paced game, making it one of the best poker games for beginners.

In 3 Card Poker game, players are dealt three cards, and they have the option to either fold or continue with a play wager. This game’s simplicity and excitement have made it a popular choice in many casinos. As poker game developers UK, AIS Technolabs provides a fully digitized version of the game that is accessible on mobile and desktop devices.

Chinese Poker Game

One of the most unique poker variants is Chinese Poker. This game, often played in Southeast Asia, is gaining popularity worldwide. In Chinese Poker, players are dealt 13 cards and must arrange them into three hands: a front hand of 3 cards, a middle hand of 5 cards, and a backhand of 5 cards. The goal is to beat the other player’s hands using Chinese poker hands combinations, such as full house or flush.

AIS Technolabs offers a top-notch Chinese poker game online that follows traditional rules and integrates modern technology to create an exciting and secure playing experience. Our Chinese poker software offers features that allow players to enjoy the game with ease, whether they’re playing with friends or in a competitive environment. It’s one of the most exciting asian card games available today.

Chinese Poker Types: AIS Technolabs’ Chinese Poker games support different variations, such as the standard version or the more competitive 13 card poker format, which requires advanced strategies. Players can learn how to organize their Chinese poker hands for the best chance to win.

Why Choose AIS Technolabs for Poker Game Development?

If you're looking for a poker game for real money or a fantastic poker game design that appeals to a broad range of players, AIS Technolabs is the right choice. Our expertise in poker game development ensures that your game is both innovative and secure, offering a seamless experience for players across the globe. Whether you’re interested in developing a Chinese poker online game, a classic Texas Holdem, or a Zynga Poker game, we have the right solutions for you.

Our team of poker game developers focuses on delivering cross-platform experiences that are accessible on Android, iOS, and PCs. From asian gambling games to poker at the empire casino, we ensure our poker games are designed with precision to meet global gaming standards.

Explore Our Premium Poker Game Solutions Today!

Conclusion

If you’re looking to roll the dice in the world of poker and achieve remarkable returns for your business, AIS Technolabs is the place to be. Our online poker software providers are dedicated to creating a poker experience that’s thrilling, secure, and rewarding. Whether you're looking to integrate a poker development company into your platform or launch an exciting poker game, we offer tailored solutions for every need.

FAQs

Ans.

AIS Technolabs offers a variety of poker games, including Texas Holdem, Omaha, Zynga Poker, 3 Card Poker, and Chinese Poker, all designed for real money play.

Ans.

Yes, AIS Technolabs poker games are designed to be cross-platform, allowing you to play on both mobile devices (Android/iOS) and desktop.

Ans.

Texas Holdem Poker is a popular variant where players are dealt two hole cards and combine them with five community cards to form the best hand possible.

Ans.

Omaha Poker is played with four hole cards, and players must use exactly two of them to make the best five-card hand, unlike Texas Holdem.

Ans.

Yes, you can download Zynga Poker software from AIS Technolabs on both Android and iOS devices to enjoy fast-paced tournaments.

Ans.

Yes, AIS Technolabs offers poker games for real money with secure payment and transaction systems to ensure player safety.

Ans.

Chinese Poker is a game where players are dealt 13 cards and must arrange them into three hands. The goal is to beat the opponent's hands based on specific combinations.

Ans.

Absolutely. AIS Technolabs incorporates advanced security measures and artificial intelligence to ensure a safe and fair gaming experience.

Ans.

Yes, AIS Technolabs is a leading poker development company providing tailored poker game development services to businesses globally.

Ans.

Yes, you can easily enjoy all the poker games offered by AIS Technolabs from the comfort of your home on both mobile and desktop platforms.